Asian markets were mixed in cautious trading Thursday as US stock futures slipped after disappointing results from companies including Netflix Inc. and Tesla Inc.

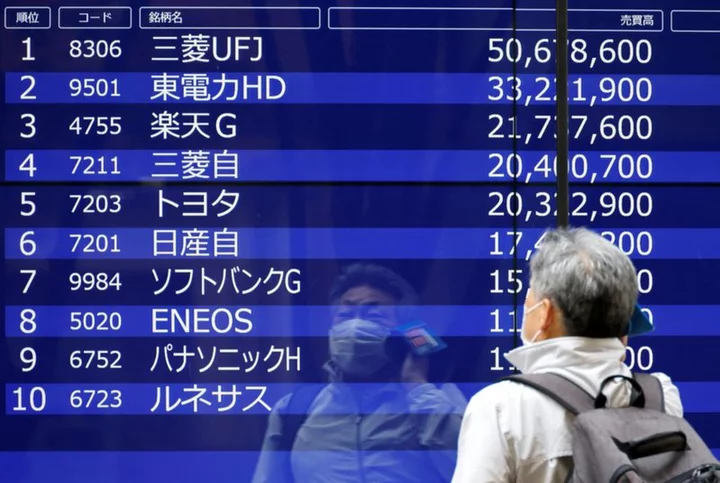

Stocks fluctuated in Japan and fell in South Korea, while Australia’s advanced. A reprieve from a two-day slide in Hong Kong may be in store, with equity futures earlier pointing to a small gain.

Investors will be watching results from Taiwan Semiconductor Manufacturing Co. due Thursday to further gauge demand in the semiconductor industry. Sales at the world’s largest supplier of made-to-order chips fell for a third month last month.

Meanwhile, futures for the S&P 500 and Nasdaq 100 ticked lower in Asia after Netflix declined 8.26% in postmarket trading as sales missed estimates and its third-quarter forecast fell short. Tesla fell 4.19% after profitability shrank in the second quarter, a sign the electric-vehicle maker’s margins are being squeezed. The S&P 500 rose for a third day and the tech-heavy Nasdaq 100 ended marginally lower Wednesday.

China will remain in focus as investors continue to expect Beijing will introduce more stimulus to revive the economy.

“China is still ‘bad news is good news,’” Jun Bei Liu, portfolio manager at Tribeca Investment Partners, said on Bloomberg Television. Stimulus measures so far have been aimed at helping cyclical sectors like housing and the consumer, “and we do think there will be more and more targeting toward that phase.”

The yen was little changed after data showed Japan’s balance of trade swung unexpectedly to a surplus in June, the first since July 2021. The dollar traded in a narrow range against all of its Group of 10 counterparts.

Treasuries steadied after gaining Wednesday as British inflation dropped to the lowest in 15 months, adding to evidence central banks can go easier on raising interest rates. The increases, however, pared back as commodities spiked on a warning from Russia that any ships to Ukraine would be seen as carrying arms.

Nearing Close

Evidence of easing price pressures in the US and UK is bolstering hopes among investors a campaign of monetary tightening is drawing to a close. However, shaky economic reports have made clear the Federal Reserve is far from claiming victory.

“The risk of recession has receded dramatically,” said Neil Dutta, head of economics at Renaissance Macro Research, on Bloomberg Television. “I think the markets are right to allocate a little bit more to the soft-landing story, but I think you can make a good case that maybe we’re getting a little bit over our skis here and we should probably put some more potential on the resurgence of the inflationary-boom scenario.”

Meanwhile in regular trading Wednesday, Apple Inc. advanced after Bloomberg reported on its efforts to build artificial intelligence tools, while Goldman Sachs Group Inc. ended in the green even after its profit slump stood in contrast to beats earlier in the week from peer investment firms.

Elsewhere, oil fell and gold was little changed.

Key events this week:

- China loan prime rates, Thursday

- US initial jobless claims, existing home sales, Conf. Board leading index, Thursday

- Japan CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 9:09 a.m. Tokyo time. The S&P 500 rose 0.2%

- Nasdaq 100 futures fell 0.6%. The Nasdaq 100 was little changed

- Japan’s Topix index fell 0.1%

- Australia’s S&P/ASX 200 Index rose 0.2%

- Hong Kong’s Hang Seng futures rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1206

- The Japanese yen was little changed at 139.55 per dollar

- The offshore yuan was little changed at 7.2267 per dollar

- The Australian dollar was little changed at $0.6776

Cryptocurrencies

- Bitcoin fell 0.1% to $29,922.66

- Ether fell 0.6% to $1,887.42

Bonds

- The yield on 10-year Treasuries was little changed at 3.75%

- Australia’s 10-year yield advanced six basis points to 3.93%

Commodities

- West Texas Intermediate crude fell 0.2% to $75.17 a barrel

- Spot gold rose 0.1% to $1,978.65 an ounce

This story was produced with the assistance of Bloomberg Automation.