Argentine dollar bonds fell sharply on Monday after a populist who vowed to burn down the central bank won surprisingly strong support in a primary vote.

The nation’s already-distressed debt led declines across emerging markets, with securities due in 2035 sliding 4 cents to 27.6 cents on the dollar as of 11:30 a.m. in London. The selloff came after Javier Milei rode voter angst to the top spot in Sunday’s primary, capturing about a third of the ballots. The congressman identifies as a libertarian and supports dollarizing the economy.

Other assets are also set for turmoil. Alejo Costa, chief Argentina strategist at BTG Pactual in Buenos Aires, said the currency will drop as much as 14% Monday on parallel markets used to skirt controls. Overnight, online cryptocurrency exchanges showed the peso weakening as much as 15% against the dollar in relatively thin trading.

Read more: Outsider Milei Upends Argentina’s Election With Primary Win

“Investors like Milei’s economic message, but fear the execution and institutional risk, considering his lack of power in congress and aggressive style,” Costa said.

The one-term congressman campaigned against a political class that he said mismanaged the economy for years, leaving the country to lurch from crisis to crisis. Argentina is poised for its sixth recession in 10 years and coping with inflation topping 100%. Milei says he can tame price increases by ditching the peso and replacing it with the US dollar — a move many economists say would cause financial mayhem.

But if the few details Milei has revealed about his agenda baffle mainstream economists, Argentines desperate to chart a new course don’t seem too worried about his threats to “burn down” the central bank. Crowds cheer when he describes politicians as delinquents, thieves and criminals who ruined the economy.

Argentina’s center-right opposition coalition came in second Sunday night with around 28% of the vote, while the left-leaning incumbent party followed with around 27% with almost 90% of the votes counted.

“The message is very clear: The fed-up, anti-establishment vote to punish the political class has won,” said Fernando Losada, a managing director at Oppenheimer & Co. in New York.

Like Brazil’s Jair Bolsonaro and Donald Trump in the US — populist outsiders that Milei is often compared with — the Argentine also holds provocative social views. He’s said he would eliminate the newly created Women’s Ministry and a government-run institution advocating against racism, tighten abortion restrictions, and make it easier to buy a gun in a country largely devoid of household firearms.

Political analysts have said his galvanizing views on social issues may make it difficult to form coalitions and push through his agenda.

The “overall market read will be negative” given the unknowns about Milei and results showing the mainstream conservative coalition, Juntos por el Cambio, underperformed, said Patrick Esteruelas, head of research at Emso Asset Management in Miami. “This will prolong the uncertainty and we may see a knee-jerk selloff.”

Relatively illiquid crypto markets showed a sharp drop in the currency, with the cost of buying Tether’s USDT stablecoin in Argentine pesos rising as much as 15% to more than 700 pesos per coin.

Uncertainty to Continue

Investors may get a better sense of the candidates’ economic proposals in coming weeks. Argentina holds its presidential vote Oct. 22, and if necessary, a runoff Nov. 19. To avoid a second round, the top candidate must receive 45% of valid votes in the first round, or 40% of them while holding onto a 10 percentage-point lead over the runner-up. An outright victory would also boost the winning party’s performance in congress.

Milei’s outperformance means it’s unlikely any one candidate will reach the required threshold to win outright in October, according to said Javier Casabal, a fixed income strategist at Adcap Securities in Buenos Aires.

“For now, Milei represents uncertainty,” Casabal said. “Most voters are unlikely to leave their coalitions, at least in massive numbers, so the base case should be a runoff in November.”

No matter who wins the top job, the incoming administration will have the monumental task ahead of calming triple-digit inflation and bringing dollars back into the central bank’s reserves, which have slumped to a 17-year low.

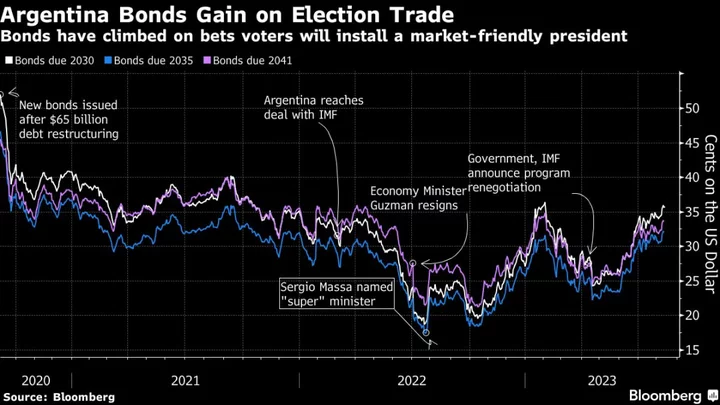

That hasn’t stopped Argentina’s S&P Merval stock index from soaring this year to its highest since 2019 in dollar terms, on expectations a change in government would usher in a more pro-business environment. The nation’s sovereign bonds are also higher on the year, although the securities trade deep in distressed territory, a signal that investors expect the economic crisis to continue.

Read More: Here Are Argentina’s Assets to Watch Before Key Primary Vote

Argentina’s exchange rate is tightly controlled by the government, which limits its daily decline through a web of currency controls, price freezes and import restrictions. That hasn’t stopped the peso from sinking more than 38% this year, making it the worst performer in emerging markets. On the parallel market, the peso has plummeted more than 75%.

The next government’s first job will be unwinding unsustainable policies, according to Claudia Calich, the head of emerging-market debt at M&G Investments.

“That’s going to be absolutely critical because there’s a huge laundry list of things the new government, whoever that may be, will need to do,” she said.

--With assistance from Carolina Wilson, Ignacio Olivera Doll and Netty Ismail.

(Adds bond performance in first and second paragraphs)