Alibaba Group Holding Ltd. returned to growth across all its main divisions, defying China’s economic turbulence to take a first step toward a long-awaited comeback after more than a year of malaise.

China’s online shopping leader, a proxy for the country’s consumer demand, reported a better-than-expected 14% rise in revenue during a quarter when the world’s No. 2 economy struggled to gain momentum after years of Covid Zero restrictions. Its shares jumped 5.3% to $99.86 on Thursday morning.

The strong showing marks a step toward the revival of a national icon grappling with a post-Covid consumption funk, up-and-comers like PDD Holdings Inc. and the lingering effects of China’s blistering crackdown on the private sector. Alibaba drove that expansion while cutting costs 6%, helped in part by a 3% reduction in its workforce or more than 6,500 people.

Alibaba, which along with Tencent Holdings Ltd. and Baidu Inc. is credited for creating China’s internet industry, now needs to win over investors to effect a complicated overhaul that will split the company six ways.

For now, the results provide a solid foundation for Alibaba co-founders Joseph Tsai and Eddie Wu as they take over leadership of the company from Daniel Zhang in September. Alibaba’s cloud division reversed its decline in the quarter and the overseas arm that includes Singapore-based Lazada and Trendyol expanded revenue 41%. Its core domestic commerce division — which now excludes certain marginal segments — chalked up its first sales rise in more than a year.

“We view the solid revenues and profit beat delivered in FY1Q24 as what the Street has been waiting for,” Citigroup analysts led by Alicia Yap wrote. “Most investors had expected an OK quarter, but the magnitude of the outperformance, especially on the profit beat, likely has exceeded most expectations.”

Alibaba reported revenue of 234.16 billion yuan ($32.3 billion) for the June quarter versus an average projection of 223.75 billion yuan. Net income rose about 50% to 34.3 billion yuan, also beating estimates.

Investors are waiting for more details on the spinoffs, including grocery arm Freshippo, the AWS-like cloud business and Cainiao logistics. In the June quarter, the cloud business returned to growth with revenue inching up 4%, while Chinese retail e-commerce revenue surged 13%.

The numbers “showed promising early results of our reorganization, which is beginning to unleash new energy across our businesses,” Zhang, who officially steps down next month, told analysts on a conference call.

Read more: Jack Ma-Backed Ant’s Profit Rises 17% in First Signs of Uplift

What Bloomberg Intelligence Says

Alibaba’s proposed listing of nearly $60 billion of assets through 2024 could give the group resources to step up its competitive efforts in China’s grocery retailing, cloud-AI and logistics sectors. Freshippo might use proceeds from an IPO valuing it at $4 billion to chase Walmart’s lead in grocery e-commerce sales. After an IPO that could value it at $45 billion, Alibaba’s cloud unit might scale up with support from new strategic investors to tackle Tencent, Huawei and China Telecom. An IPO of Cainiao, perhaps valued at $10billion, could accelerate the logistics unit’s expansion in China and overseas.

- Catherine Lim and Trini Tan, analysts

Click here for the research.

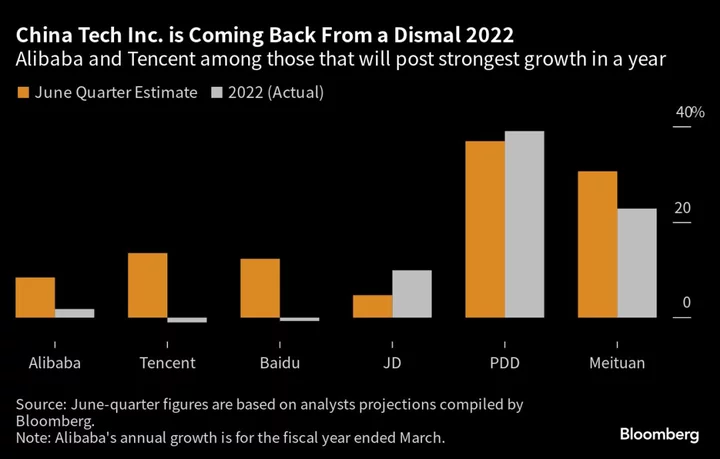

China’s largest tech companies Alibaba and Tencent Holdings Ltd. have gained some $70 billion of market value since May’s end, propelled by expectations of a gradual return to the consistent double-digit growth they enjoyed before Beijing launched a regulatory assault against its biggest private companies in 2020.

Driven by a need to rejuvenate the world’s No. 2 economy, Xi Jinping has in recent months led Party cadres and state media in proclaiming Beijing’s support for a sector wracked by two years of unpredictable diktats. In July, Beijing signaled it’s ready to unfetter the sector when it wrapped up a probe into Jack Ma-backed Ant Group Co.

Yet some investors warn the celebration may be premature.

Chinese policymakers have stopped short of providing direct, major fiscal or policy support for businesses, and consumer spending remains muted thanks to a subdued outlook for wages and record-high youth unemployment. Profit margins remain under pressure amid rising competition from upstarts that mostly escaped the brunt of the crackdown such as ByteDance Ltd. and PDD.

Alibaba and Tencent cut more than 20,000 jobs between them last year to survive regulatory and economic turmoil. They face a two-pronged assault: rivals like Baidu Inc. and Meituan are vying for dominance of the Internet thanks to the emergence of generative AI. Baidu has so far stolen much of their limelight in the post-ChatGPT race, debuting Ernie in March before launching into several iterations.

Abroad, ByteDance and PDD’s Temu continue to make strides, building on expansions that began when Alibaba and Tencent were forced to show restraint. During the crackdown, companies including ByteDance’s TikTok and Temu revved up overseas forays for growth. Despite rising geopolitical tensions, this generation of upstarts offer a template for older peers seeking to regain pre-crackdown heights.

“There’s uncertainties ahead of us on this road,” Taobao and Tmall chief Trudy Dai said. “But I think faced with all these uncertainties and potential volatility, the greatest certainty we have is the need to continue to grow our user scale and our merchant scale.”

--With assistance from Debby Wu, Vlad Savov and Henry Ren.

(Updated shares in second paragraph.)